The history of Google's default deals with Apple

Day 19: DOJ called one of Google's first employees to examine the push and pull of Google's negotiations with Apple over the years.

The exact size of Google’s revenue share with Apple in exchange for default status on Apple’s Safari browser remains a closely guarded secret — but today, testimony from one of Google’s longest-tenured employees provided a window into the history of the negotiations that have resulted in the massive 11-figure payments.

That employee was Joan Braddi, who joined Google in 1999 as the company’s 15th employee. She now works for Google as a global partnerships executive, managing Google’s relationships with key partners like Amazon, Apple, Microsoft, and Meta. For much of her career at Google until 2015, she was in charge of search distribution, which was the topic of much of her testimony. The DOJ’s questioning of Braddi painted a picture of Google insisting on exclusive default status against pushback from Apple and even internal concerns from the future CEO of the company.

In 2007 amidst a renegotiation of Google’s default search engine agreement with Apple — which according to Braddi was first formed in 2002 without any exchange of money — Braddi exchanged emails about the negotiations with other executives including Sundar Pichai (who went on to become CEO of Alphabet/Google in 2015).

During this exchange, Pichai sent Braddi an email that read in part: “I know we are insisting on default but at the same time I think we should encourage [Apple] to have Yahoo as a choice in the pull down or some other easy option. I don’t think it is a good user experience nor the optics is great for us to be the only provider in the browser.”

I missed the exact date of Pichai’s email, but it was around this same time frame in 2007 that Braddi received an email from another colleague Jeff Shardell, which summarized the position that Google had presented to Apple: “No default placement — no revenue share on Safari/Windows.” This wasn’t the first time we had seen this email as the DOJ also included this email in its opening statement.

The DOJ presented various other exhibits that highlighted Apple’s various requests over the years for additional flexibility in the default search engine arrangement being met with resistance by Google. For example in 2009, Apple pushed to have the option to set Google as the default in exchange for revenue share without having the obligation to do so. Braddi testified that this proposal never made it into the deal.

In the years to follow, Google worked to limit the number of Google searches it lost to Apple’s Spotlight suggestions diverting users directly to websites before they entered their search. DOJ presented an internal slide deck voicing at least one perspective within Google about the risk of Apple’s search suggestions.1

One slide in this exhibit was titled” “Bottom Line: It’s bad”. The slide’s text explained that “[i]n iOS 8, Apple’s is introducing Spotlight suggestions into Safari search. We expect these suggestions to siphon queries away from Google in verticals where Spotlight is triggered.”

That concern resulted in Google negotiating a new clause in its 2016 agreement with Apple that prohibited Apple from expanding the search suggestion feature beyond its current levels unless doing so provided a superior user experience.

The broader narrative that DOJ seemed to push of Google bullying its way to default exclusivity was challenged during Google’s cross examination of Braddi, which pointed out that it’s entirely normal for parties to start negotiations with extreme offers on either side before reaching an agreement in the middle. According to Braddi, neither Apple nor Google was ever able to get everything it wanted out of the default deals.

DOJ’s direct examination also called attention to the fact that Google partnered with Apple to the tune of billions of dollars despite the fact that Apple’s iOS represented the biggest competitor of Google’s Android operating system. Braddi testified that the default deal places no conditions on how Apple uses the payments it receives from Google and that she is “sure” the payments are used to improve iOS.

It seemed like DOJ pursued this line of questioning to underscore the importance of the default placements to Google; that is, the defaults were so strategically important to Google that it was worth sharing huge sums of money with its main rival in the mobile operating system space.

But it also potentially bears on what I understand to be an open legal question in this case: whether Judge Mehta’s competitive analysis of the default agreements can take into account benefits from outside relevant markets. That is, can Google argue the default agreements are pro-competitive because the agreements have pro-competitive effects in outside markets such as lowering the consumer price of iPhones?

That kind of argument hasn’t really surfaced from Google yet, but Judge Mehta denied the DOJ’s pretrial motion in limine to exclude evidence of purported benefits from outside relevant markets — which means Google can present this kind of evidence if it wants to. (As I mentioned above, I understand it to be an open legal question whether Judge Mehta can actually rely on this kind of evidence in determining whether or not the deals are anti-competitive.) I’ll be paying attention to whether Google presents this kind of evidence once it gets the chance to start presenting its defense in a couple of weeks.

The debate over digital advertising markets continues

Coming into today we had heard multiple witnesses share conflicting views about whether Google’s search advertisements face meaningful competition from other major digital platforms like Facebook and Amazon. Early in the trial, Google advertising executive Jerry Dischler testified about Google’s competition for a “piece of the digital advertising pie.” More recently, Joshua Lowcock, a media agency executive, that search advertisements are “mandatory” for any advertiser. Much of the testimony from these witnesses goes directly to the key question of whether general search text advertising, search advertising, and general search advertising are their own relevant antitrust markets.

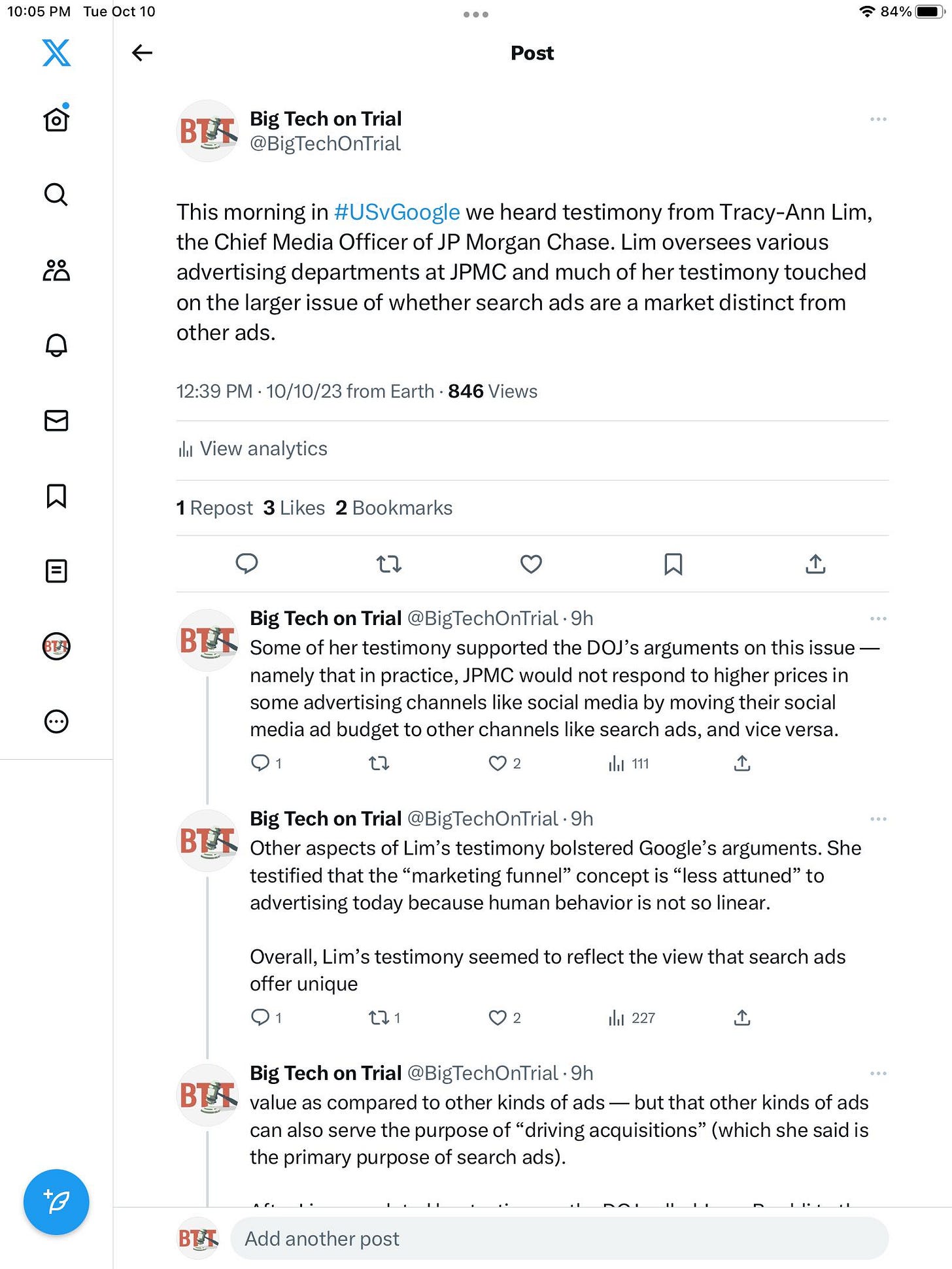

This morning, we heard another perspective on that issue from Tracy-Ann Lim, the Chief Media Officer of JPMorgan Chase who oversees various advertising departments at the financial services company. Here was my summary of her testimony on X/Twitter:

That’s all for today. Braddi finished all of her testimony so we’ll hear from a new witness tomorrow morning. The DOJ’s case is winding down, so I expect most of the remaining witnesses before Google begins its defense to be focused on the States’ separate claims about Google’s SA360.

I have not yet been able to read through it closely, but much of the unsealed testimony of Apple executive (and former Google head of search) John Giannandrea was focused on Apple’s development of its own search-related technologies such as Spotlight and search bar suggestions.